Whether you're buying or selling a business in Massachusetts, one of the most important legal and financial decisions you'll face is determining how the sale will be structured. In 2025, with an evolving tax landscape and increased focus on liability protection, understanding the difference between a business stock sale and a business asset sale in Massachusetts is critical.

At Percy Law Group, PC, we frequently counsel business owners, corporate buyers, and entrepreneurs on these pivotal decisions. This article will break down the key differences between stock and asset sales, how Massachusetts law affects each structure, and which option might make the most sense for your situation.

Overview: Two Distinct Paths to Buying or Selling a Business

When it comes to the transfer of business ownership, there are two primary structures:

- Stock Sale – The buyer purchases the shares of the selling entity, assuming ownership of the entire business, including its assets and liabilities.

- Asset Sale – The buyer purchases individual assets and assumes selected liabilities, while the legal entity itself remains with the seller.

Both have benefits and risks, and the best choice depends on tax consequences, liability concerns, and operational priorities.

What Is a Business Stock Sale?

In a business stock sale, the buyer purchases the equity (stock or membership interests) of the company. The legal entity continues to exist as is, with the new owner taking over all its assets, contracts, and liabilities—both known and unknown.

Advantages for the Seller:

- Tax efficiency: Gains from the sale of stock are typically taxed at long-term capital gains rates.

- Simplicity: Fewer complications with transferring contracts, licenses, and permits.

- Clean exit: The seller generally walks away from ongoing obligations, as the entity remains intact.

Risks for the Buyer:

- Liability inheritance: The buyer assumes responsibility for all business liabilities, including those that may not be immediately apparent (e.g., pending litigation, environmental issues, unpaid taxes).

- No asset step-up: The buyer doesn’t get to revalue the company’s assets for depreciation or amortization purposes, potentially limiting future tax deductions.

What Is a Business Asset Sale?

A business asset sale in Massachusetts involves selling individual components of the business, such as equipment, inventory, customer lists, intellectual property, and goodwill. The buyer typically does not acquire the actual corporate entity.

Advantages for the Buyer:

- Selective acquisition: The buyer chooses which assets and liabilities to assume.

- Tax benefits: Allows for a “step-up” in asset basis, enabling greater depreciation and amortization.

- Reduced liability: The buyer avoids legacy liabilities unless they agree to take them on.

Challenges for the Seller:

- Potential double taxation: For C corporations, the company pays tax on the sale of assets, and the shareholders pay tax again on the distribution of proceeds.

- More complex transfer: Each asset may require separate documentation, and contracts, licenses, and permits might need third-party consents.

Massachusetts-Specific Considerations for 2025

While the core legal principles of stock vs. asset sales are similar nationwide, Massachusetts has several unique considerations in 2025:

1. State Capital Gains Treatment

Massachusetts follows federal long-term capital gains tax rates in most cases. This favors sellers in stock transactions, particularly where the stock qualifies for favorable treatment under IRS §1202 (Qualified Small Business Stock).

2. Sales Tax on Assets

When selling tangible personal property in an asset sale, Massachusetts imposes a sales tax. This can add a financial burden to the transaction if not properly addressed.

3. Transfer of Licenses and Permits

Many licenses issued by Massachusetts state agencies are not transferable. This can complicate asset sales in industries like hospitality, health care, or construction.

4. Successor Liability

While asset sales can shield buyers from liability, Massachusetts courts may find successor liability in cases where:

- The buyer continues the business under the same name.

- There’s continuity of management or personnel.

- The sale is intended to escape creditor obligations.

Legal counsel from a firm like Percy Law Group, PC, can help buyers structure the deal to avoid these pitfalls.

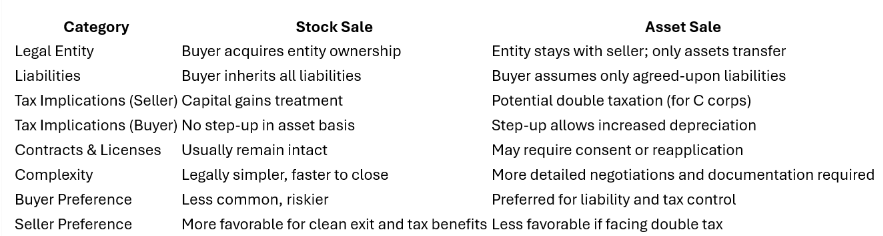

Stock Sale vs. Asset Sale: A Side-by-Side Comparison

Which Structure Is Right for You?

The optimal structure often comes down to negotiation power, tax position, and liability concerns.

Stock Sale May Be Better If:

- You’re a seller looking for capital gains treatment and a clean break.

- The business has long-term contracts or licenses that are hard to assign.

- The buyer is comfortable taking on existing liabilities or has done thorough due diligence.

Asset Sale May Be Better If:

- You’re a buyer seeking to avoid legacy liabilities and maximize tax benefits.

- The business has obsolete or unwanted assets that you want to exclude.

- You need the flexibility to renegotiate vendor or customer contracts.

In many cases, buyers and sellers meet in the middle—negotiating indemnification clauses, escrow accounts, and specific deal terms to allocate risk.

Legal Counsel Is Essential

Whether you are buying or selling a business in Massachusetts in 2025, the consequences of choosing the wrong deal structure can be costly. From navigating complex tax issues to avoiding post-sale liability, having experienced legal counsel on your side is critical.

At Percy Law Group, PC, we’ve helped hundreds of Massachusetts clients successfully close business sales. Our business law team offers clear guidance, thorough contract review, and customized deal structuring that aligns with your goals and protects your interests.

Final Thoughts

The difference between a business stock sale and a business asset sale in Massachusetts is more than legal jargon—it’s a defining factor in the success of your transaction. Each path has its risks and rewards, and what’s best for one party may not work for the other.

In 2025, the business landscape continues to shift. Don’t go into a deal unprepared.

Contact Percy Law Group, PC, today to schedule a consultation with our business law attorneys and get the experienced guidance you need.